[ad_1]

A worse-than-expected drop in worldwide PC shipments signals the end of the market’s pandemic boom, experts said.

Second-quarter shipments of desktops, laptops and workstations fell 15.3% year over year, research firm IDC reported this week. After two years of growth, it was the second straight down quarter for the PC market. Sluggish corporate demand was one of several factors that led to the decline, according to industry observers.

“Overall, the PC boom of the COVID era is over,” said IDC analyst Jitesh Ubrani.

Manufacturers shipped less than 80 million PCs for the first time in seven quarters, managing just 71.3 million devices, down from 80.5 million in the previous quarter. Despite the decline, the market remains above its pre-pandemic figures. In the second quarter of 2019, manufacturers shipped 65.1 million PCs.

Recession fears have dampened PC demand, with businesses and consumers tightening their belts, Ubrani said. A U.S. Commerce Department report said household spending grew at the slowest pace of the year in May.

Business PC demand hasn’t fallen as fast. However, some companies have delayed purchases in the face of economic uncertainty, Ubrani said.

Other businesses are looking for lower-cost computers rather than high-performance, easy-to-manage systems that cost more, said Mark Bowker, an analyst at Enterprise Strategy Group (ESG). An ESG survey of 378 corporate IT buyers found that only 21% prioritized low cost. But Bowker expects that percentage to increase significantly, and IDC reported healthy demand for Windows PCs in the low-mid range.

Computer saturation is also an issue along with economic concerns, said Gartner analyst Mikako Kitagawa. Many companies that need laptops to accommodate remote and hybrid work have already purchased them. As a result, business demand will decrease until companies need to replace the computers they bought earlier in the pandemic. Kitagawa doesn’t expect that refresh cycle to begin until 2024.

Supply chain and logistics issues wreaked havoc in the second quarter as well. China locked down dozens of cities in the spring, disrupting the country’s manufacturing sector. Also, many computer manufacturers gave up sales when they stopped doing business in Russia after its invasion of Ukraine.

China has reopened its cities, but experts don’t think it’s enough to change the current trend of the PC market. IDC expects the decline to continue for the rest of the year.

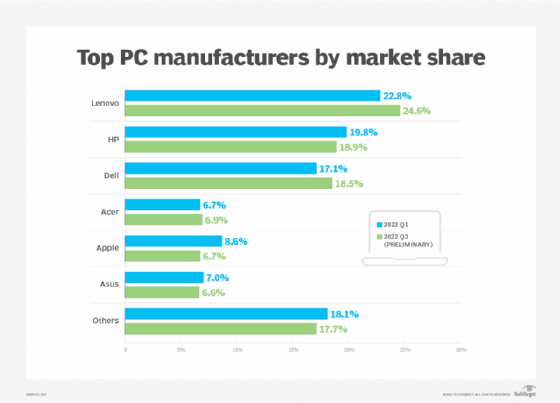

The top three PC manufacturers remained the same from last quarter, according to IDC. Lenovo gained market share, accounting for 24.6% of shipments as opposed to 23.7% in 2021. HP and Dell held 18.9% and 18.5% of the market, respectively.

Acer was fourth, with a 6.9% share.

Apple, which relies on Chinese manufacturers, slipped from fourth place due to a drop in production, IDC said. The company fell into a statistical tie with Asus for fifth, with about 6.7% of the market. Apple is likely to rebound in the second half of 2022, according to IDC.

Enterprise Strategy Group is a division of TechTarget.

Mike Gleason is a reporter on unified communications and collaboration tools. He previously covered communities in the MetroWest region of Massachusetts for the Milford Daily News, Walpole Times, Sharon Advocate and Medfield Press. He also worked for newspapers in central Massachusetts and southwestern Vermont and served as a local editor for patch. He can be found on Twitter at @MGleason_TT.

[ad_2]

Source link