[ad_1]

TooTH_PIK/E+ via Getty Images

Investment thesis

I think the stock price of Ranger Oil Corporation (NASDAQ: ROCC) will increase based on the overall oil market and ROCC steps. There are positive developments in pricing and EPS plus consumption and production. Operational improvements, a strong balance sheet, and share repurchases and acquisitions will all contribute to ROCC’s share price growth. Even if ROCC’s share price moves only from $38.50 to $40.00 by April 21, a potential annual return of 44.8% is possible, including the call premium and dividends.

Ranger Olya

Ranger Oil Corporation is an independent oil and gas company engaged in the onshore development and production of crude oil, natural gas liquids and natural gas. The company’s business is drilling unconventional horizontal wells to develop and operate its production wells in the Eagle Ford Shale (Eagle Ford) in South Texas. Their land leases are 100% private and not subject to federal influence. Their location gives them direct access to Gulf Coast markets and minimizes dependence on federally regulated pipelines.

89.7% of them belong to institutions. I believe that institutional investors such as hedge funds, pension funds, mutual funds and endowments are smart money because they have more research resources than retail traders. They control much more of the buying and selling than retail investors, which determines the share price. Retail investors currently account for about 10% of daily trading volume in the Russell 3000, according to Reuters.

On October 19, ROCC published preliminary results for the third quarter. Their third quarter conference call is scheduled for November 3rd. Further details on the four points below from their press release are available on the company’s website. I see this as further evidence that Ranger Oil is making the right moves to cause its stock price to rise.

- Total sales volumes exceed the maximum target level

- Capital costs for drilling and completing wells within guidance

- The company adds a third rig in the fourth quarter, creating significant momentum for 2023

- About $70 million has been returned to stockholders since May, reducing the number of shares by nearly 5%

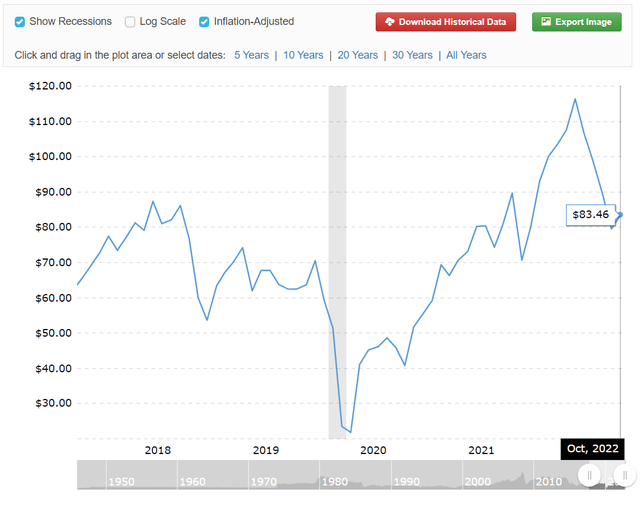

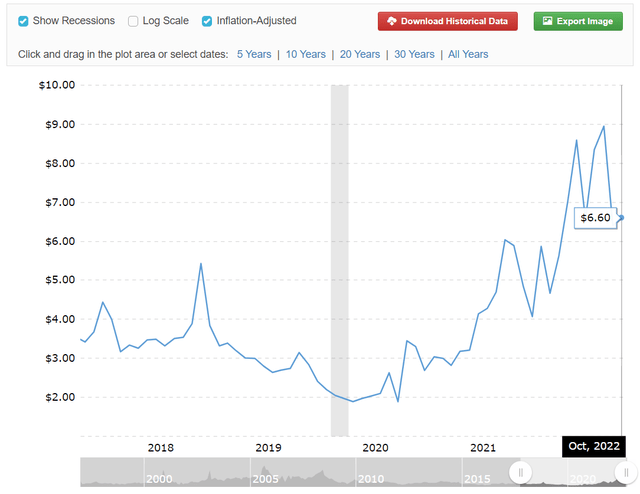

The price of oil and natural gas

Crude oil and natural gas prices in West Texas are above five-year averages. This helps producers to be more profitable. I think the average West Texas oil price is around $85 a barrel in 2023.

www.macrotrends.net/1369/crude-oil-price-history-chart www.macrotrends.net/2478/natural-gas-prices-historical-chart

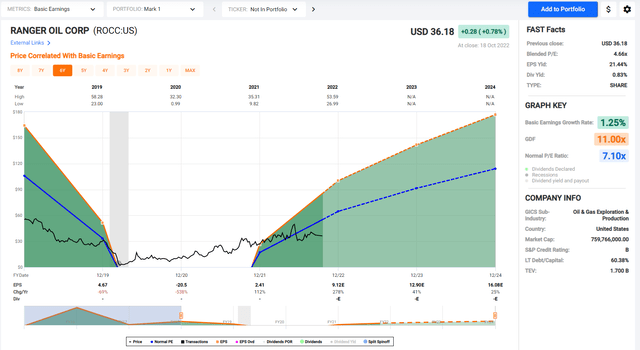

ROCC’s earnings per share are improving

The black line shows ROCC’s stock price over the past few years. Take a look at the number chart below the graph to see that ROCC had negative earnings per share in 2020. Earnings are expected to grow 41% from around $9.12 in 2022 to $12.90 in 2023. They have a forward P/E of 3.1. ROCC’s stock price could rise significantly if the market assigns it a higher P/E ratio.

FastGraphs.com

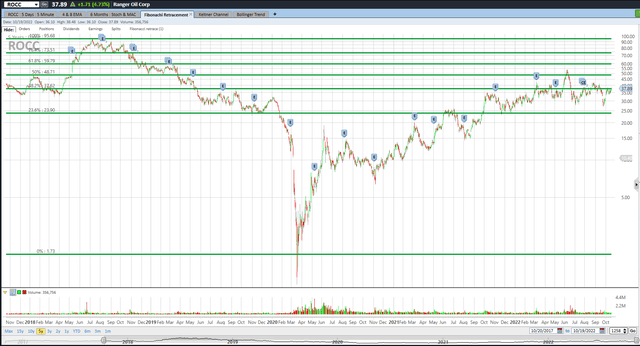

I added the green Fibonacci lines using the last five year high and low for the ROCC. It is interesting to note how the market stops or bounces off these Fibonacci lines. They may be one of the clues as to where the ROCC is headed. ROCC can reach the $37.65 38.2% Fibonacci retracement level or even lower. However, I believe ROCC will trade above $40 by April for the reasons described in this article.

Schwab Streetsmart Edge

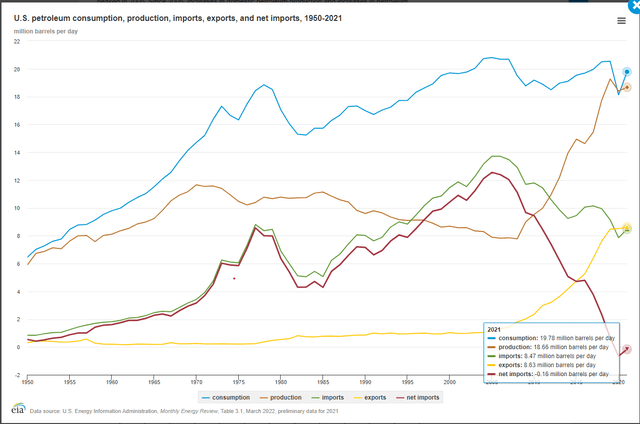

Consumption, production, import and export of oil

In 2021, the US produced 18.66 million barrels of oil per day and consumed 19.78. We exported 8.63 million barrels per day and imported 8.47, making us a net exporter. In 2020 and 2021, annual total net oil imports were negative, at least since 1949.

www.eia.gov/energyexplained/oil-and-petroleum-products/imports-and-exports.php

OPEC and its allies, including Saudi Arabia and Russia, control more than 40% of global oil production. They announced that the 2 million bpd cut would take effect in November. This reduction is equivalent to approximately 2% of global oil demand. “Any announced output cuts are unlikely to be fully implemented by all countries, as the group is already 3 million barrels per day behind its stated production ceiling,” Rystad Energy analyst Jorge Leon said in a note.

Oil consumption is not increasing as it was many years ago, but neither is it showing a significant decline, except for a short-term period during the pandemic. Oil producers seem to be doing everything they can to keep their profits high, even if that means higher oil prices.

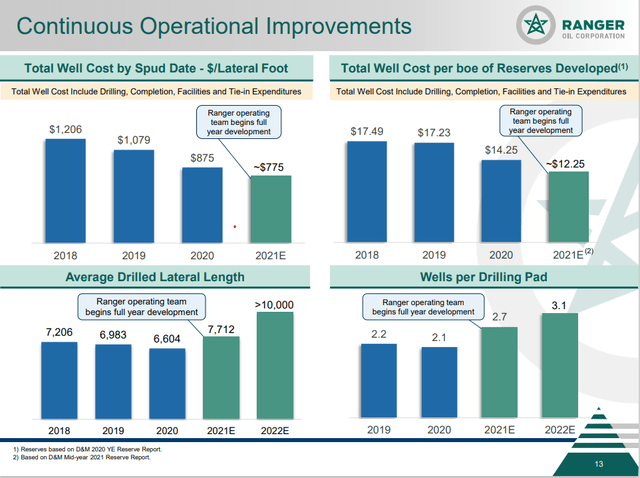

Operational improvements and debt reduction

ROCC continues to cut well costs. They drill more wells per pad with a longer cross-sectional length.

www.rangeroil.com/news-media/presentations

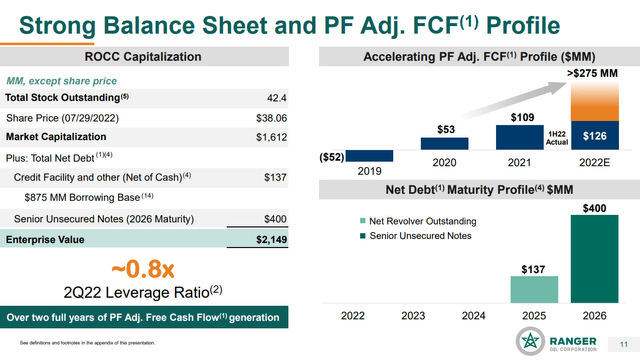

ROCC has a low net debt to forward EBITDA ratio of 0.4, with no commitments until 2025. S&P’s ROCC credit rating is B. Free cash flow is accelerating every year. ROCC has a free cash flow yield per share of 10.2%.

www.rangeroil.com/news-media/presentations

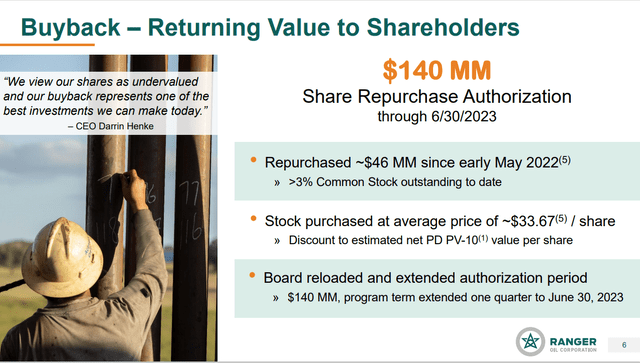

Redemption and acquisition of shares

ROCC buys back shares, which returns value to shareholders. They have a 3.3% buyback yield per share.

www.rangeroil.com/news-media/presentations

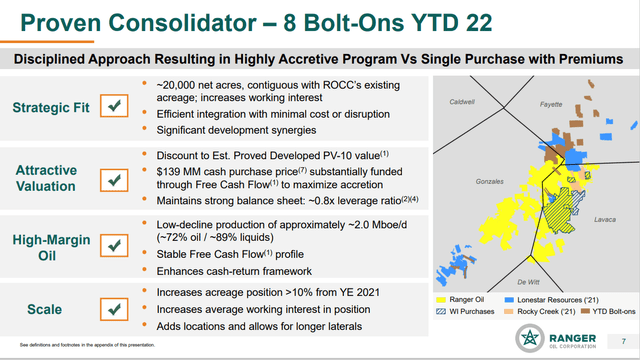

They have acquired eight smaller companies this year. Smaller companies are easier to integrate. Synergy allows you to reduce costs. They seem to be able to grow both topline and net income while keeping the balance sheet in good shape.

www.rangeroil.com/news-media/presentations

The Seeking Alpha ranking summary and factor scores show strength in all areas.

| In search of Alpha | ROCC |

| S. A. Authors | to buy |

| Wall Street | Strong buy |

| Number | Strong buy |

| Rating | AND- |

| growth | AND- |

| Profitability | B- |

| Pulse | B- |

| Revisions | B- |

Sell call coverage

My response to uncertainty is to sell covered calls on ROCC six months from now. ROCC was trading at $38.50 on 10/20 and the April $40.00 calls were at or near $7.00. 100 shares must be purchased for one covered call. Selling April covered calls will allow the investor to receive dividends in October and January of $0.075. It will be canceled if the stock price exceeds $40 on April 21. It can be called back early if the price goes above $40, but that’s fine with me because I’ll get my capital back early.

The investor can earn $700 from the call premium, $15 from the dividend, and $150 from the stock price appreciation. That’s a total of $865 in expected return on an investment of $3,850, which is a 44.8% annualized return since the period is 183 days.

If the stock is below $40 on April 21st, investors will still profit from this trade to a net share price of $31.35. Selling covered calls and receiving dividends reduces your risk.

On October 13, RBC Capital set a one-year target price of $52.00. This suggests a 39% growth potential if they are correct. Seaport Global and Truist Financial have $55 and $68, respectively.

Takeaway

Operational improvements, a strong balance sheet, and share repurchases and acquisitions will all contribute to ROCC’s share price growth. Even if ROCC’s share price moves only from $38.50 to $40.00 by April 21, a potential annual return of 44.8% is possible, including call premiums and dividends. ROCC is a small company with $934 million in sales, 136 employees and a market cap of $741 million, so I suggest keeping access to a small portion of the portfolio.

[ad_2]

Source link