[ad_1]

To those keeping an eye on the market, reports of softening demand for PCs by consumers have almost become background music in recent months. So for many, the important questions are how significantly the market will contract in 2022 and when it will recover. IDC on Friday said the market will contract by 43.5 million units a year in 2022, and won’t return to growth for another year.

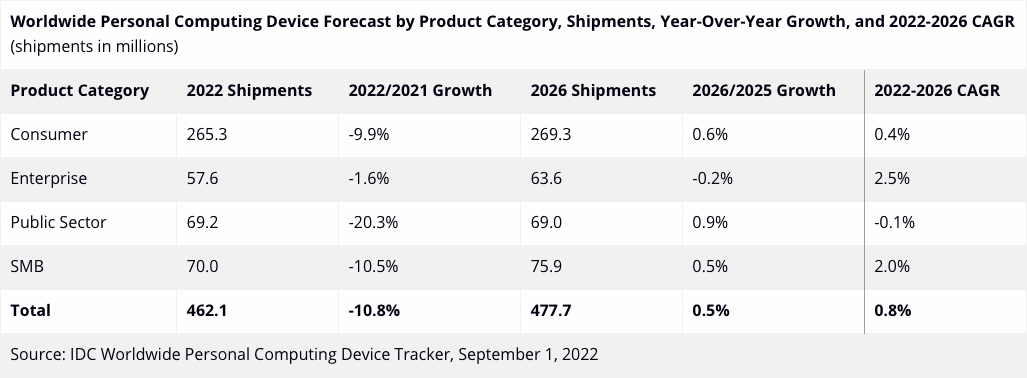

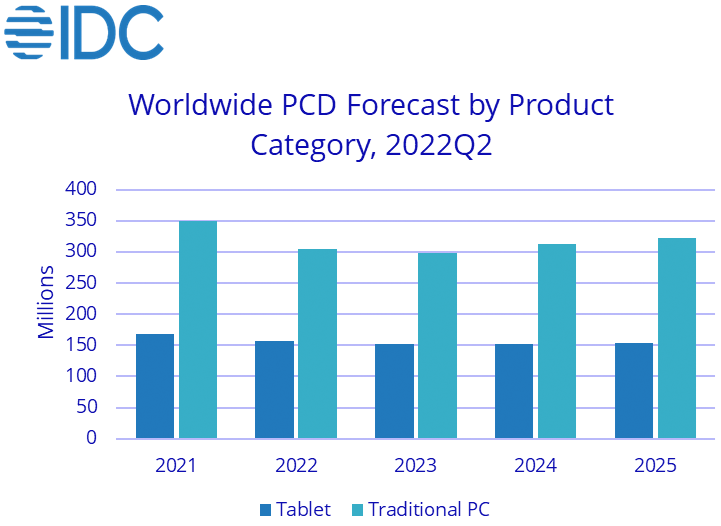

IDC believes that PC unit shipments will total 305.3 million units in 2022, down 12.8% from 348.8 million units in 2021. Tablet sales will fall to 156.8 million units, or 6.8% from the previous year. Overall, shipments of personal computing devices (computers and tablets, or PCDs) will decrease to 462.1 million units, down 10.8%, in 2022 compared to 2021. Sales of PCDs will further contract by 2.3% in 2023 before a rebound in 2024. But. while shipments of computers and tablets are higher than they were in pre-pandemic years, they will not return to pre-pandemic peaks, even in 2025.

IDC sees a saturation of computers in the hands of consumers, a weak global economy and inflation as main causes for the reduced outlook.

“Long-term demand will be driven by a slow economic recovery combined with an enterprise hardware refresh as support for Windows 10 nears its end. Educational deployments and hybrid work are also expected to become a main driver of additional volumes,” said Jitesh Ubrani, research. manager for IDC Mobility and Consumer Device Trackers.

One of the things that has been highlighted recently is that consumers are slowing their spending on PCs and tablets, while the enterprise market continues to buy new hardware. Indeed, IDC believes that consumers will buy 9.9% less PCD this year, while enterprise purchases will contract by a modest 1.6%. But apparently, consumers aren’t leading the pack here, as small businesses plan to reduce their purchases by 10.5% in 2022, while the public sector (government agencies, schools) will cut their PCD consumption by a whopping 20.3%.

“With economic headwinds gathering pace, we expect worsening consumer sentiment to result in further contractions in the consumer market over the next six quarters,” said Linn Huang, research vice president, Devices & Displays, IDC. “An economic recovery in time for the next major refresh cycle could drive some growth in the outer years of our forecast. Although volumes will not hit pandemic peaks, we expect the consumer market to drive to higher end of the market.”

The IDC data is indirectly confirmed by Jon Peddie Research’s report from earlier this week, which says that PC CPU shipments to PC makers fell 33.7% year-on-year and discrete desktop graphics card sales fell 9.6% YoY in Q2 2022. Note that IDC counts computer cases sold to distributors or end users, while JPR counts chips sold to hardware manufacturers. The fewer chips delivered to PC manufacturers in Q2 2022, the fewer PCs will be sold in the next quarter.

[ad_2]

Source link